How Entity Type Affects Tax Planning for Owner-Employees

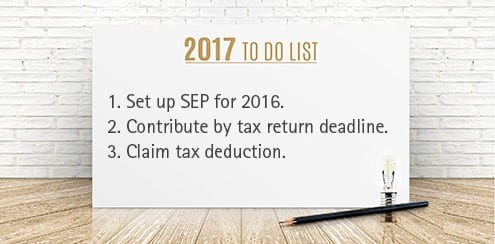

Come tax time, owner-employees face a variety of distinctive tax planning challenges, depending on whether their business is structured as a partnership, limited liability company (LLC) or corporation. Whether you’re thinking about your 2016 filing or planning for 2017, it’s important to be aware of the challenges that apply to