2020-2021 Online Tax Planning Guide

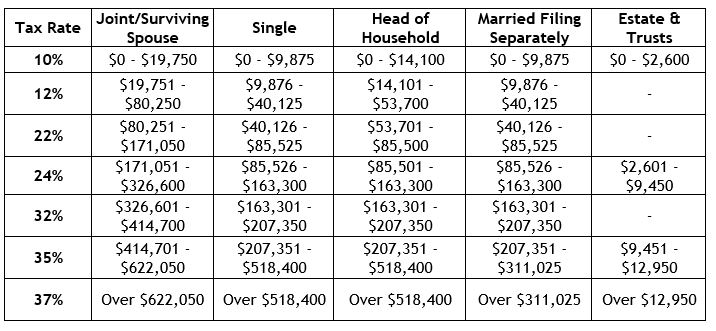

Although you can’t avoid taxes, you can take steps to minimize them. This requires proactive tax planning — estimating your tax liability, looking for ways to reduce it and taking timely action. To help you identify strategies that might work for you in 2020, check out our Online Tax Planning