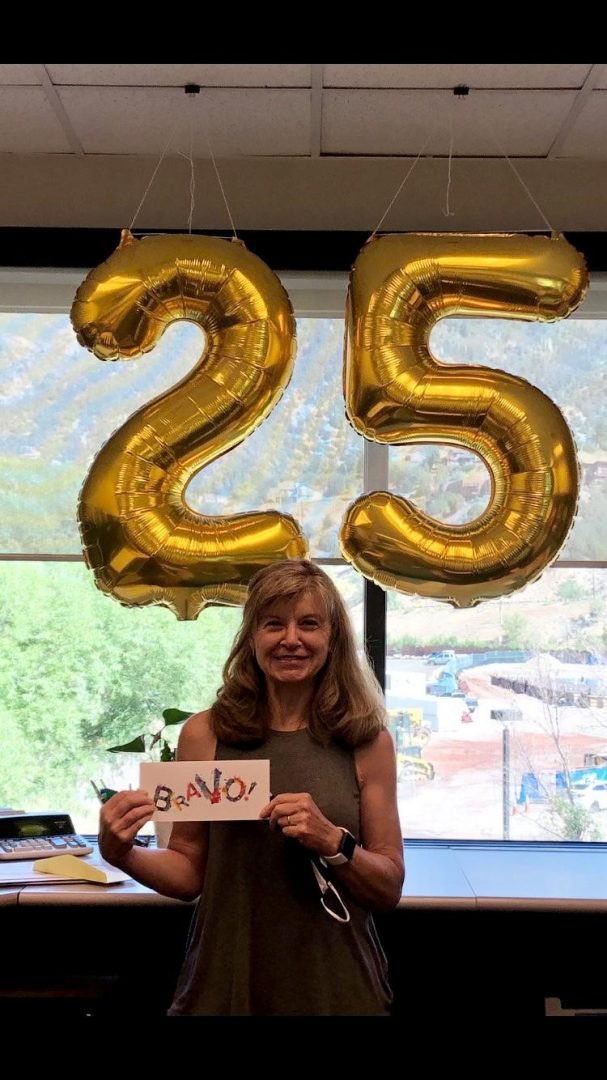

DWC’s Denise Distel Receives QuickBooks Online Advanced Certification

Dalby, Wendland & Co., P.C., (DWC) is pleased to announce Bookkeeper Denise Distel recently attained designation as a QuickBooks Online Advanced Certified ProAdvisor. The QuickBooks Online Advanced Certification is a coveted certification for ProAdvisors who are looking to distinguish themselves to help solve complex problems for their clients, including advanced