Blog

IRS Publishes Numbers for 2024

The IRS has issued numbers to help you understand what the 2024 tax situation will be like. Below is a summary. The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For single taxpayers and married individuals

Are scholarships tax-free?

With the rising cost of college, many families are in search of scholarships to help pay the bills. If your child is awarded a scholarship, you may wonder about how it could affect your family’s taxes. Good news: Scholarships (and fellowships) are generally tax-free for students at elementary, middle and

Wage Base for Computing Social Security Tax to Increase in 2024

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Basic Details of Employment Taxes The Federal Insurance Contributions Act (FICA)

Can you deduct 2024 bonuses this year?

You may be familiar with the rule that permits a business to deduct employee bonuses this year if it pays them within 2½ months after the end of the tax year. It’s an attractive year-end planning technique that benefits your business and your employees: You enjoy a tax deduction this

A Review of the Trust Fund Recovery Penalty

One might assume the term “trust fund recovery penalty” has something to do with estate planning. It’s important for business owners and executives to know better. In point of fact, the trust fund recovery penalty relates to payroll taxes. The IRS uses it to hold accountable “responsible persons” who willfully withhold

Why and How to Avoid Probate

Few estate planning subjects are as misunderstood as probate. But circumventing the probate process is usually a good idea, and several tools are available to help you do just that. Why should you avoid probate? Probate is a legal procedure in which a court establishes the validity of your will,

IRS Announces New 2024 Business Per Diem Travel Rates Effective October 1, 2023

Are employees at your business traveling and frustrated about documenting expenses? Or perhaps you’re annoyed at the time and energy that goes into reviewing business travel expenses. There may be a way to simplify the reimbursement of these expenses. In Notice 2023-68, the IRS announced the fiscal 2024 special “per

Is a Health Savings Account Right for You?

With the escalating cost of health care, many people are looking for a more cost-effective way to pay for it. For eligible individuals, a Health Savings Account (HSA) offers a tax-favorable way to set aside funds (or have an employer do so) to meet future medical needs. Here are four

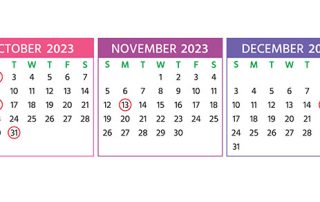

2023 Q4 Tax Calendar: Key Deadlines for Businesses and Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more

Percentage-of-Completion Method for Long-Term Projects

Does your business work on projects that take longer than a year to complete? Recognizing revenue from long-term projects usually requires use of the “percentage-of-completion” method. Here’s an overview of when it’s required and how it works. Completed Contract vs. Percentage-of-Completion Homebuilders, developers, creative agencies, engineering firms and others who