Blog

Tax Implications of Selling Mutual Fund Shares

If you’re an investor in mutual funds or you’re interested in putting some money into them, you’re not alone. According to the Investment Company Institute, a survey found 58.7 million households owned mutual funds in mid-2020. But despite their popularity, the tax rules involved in selling mutual fund shares can

Cash vs. Accrual Accounting Methods

Small businesses may start off using the cash-basis method of accounting. But many eventually convert to accrual-basis reporting to conform with U.S. Generally Accepted Accounting Principles (GAAP). Which method is right for you? Cash Method Under the cash method, companies recognize revenue as customers pay invoices and expenses when they

A Beneficiary Designation or Joint Title Can Override Your Will

Inattention to beneficiary designations and jointly titled assets can quickly unravel your estate plan. Suppose, for example, that your will provides for all of your property to be divided equally among your three children. But what if your IRA, which names the oldest child as beneficiary, accounts for half of

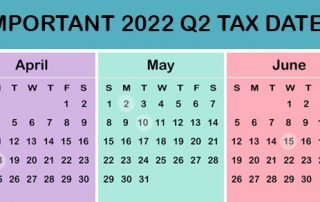

Q2 2022 Tax Deadlines

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to

Tax Rules of Renting Out a Vacation Property

Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the year. Number of Days Rented and Personal Use The tax treatment depends on how many days it’s rented and your

Establish a Tax-Favored Retirement Plan

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a

When Inheriting Money, Be Aware of “Income in Respect of a Decedent” Issues

Once a relatively obscure concept, “income in respect of a decedent” (IRD) may create a surprising tax bill for those who inherit certain types of property, such as IRAs or other retirement plans. Fortunately, there may be ways to minimize or even eliminate the IRD tax bite. Basic Rules For

Owning Real Estate in More Than One State May Multiply Probate Costs

One goal of estate planning is to avoid or minimize probate. This is particularly important if you own real estate in more than one state. Why? Because each piece of real estate titled in your name must go through probate in the state where the property is located. Cost and

Smart Estate Planning for Blended Families

If you’re married and have children from a previous marriage plus children or stepchildren from your current marriage, your family is considered a blended family. And because you’ll likely wish to pass your wealth on to all of your biological children but also provide for your spouse and perhaps any

The Four Types of Audit Opinions

The first page of audited financial statements is the auditor’s report. This is an important part of the financials that shouldn’t be overlooked. It contains the audit opinion, which indicates whether the financial statements are fairly presented in all material respects, compliant with Generally Accepted Accounting Principles (GAAP) and free