Blog

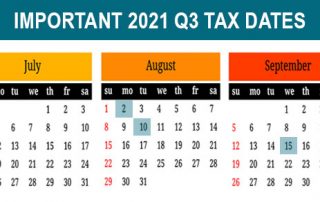

2021 Q3 Tax Deadlines Calendar for Businesses and Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more

Tax Issues for Retirees

If you’re getting ready to retire, you’ll soon experience changes in your lifestyle and income sources that may have numerous tax implications. Here’s a brief rundown of four tax and financial issues you may deal with when you retire: Taking required minimum distributions. This is the minimum amount you must

EEOC Publishes Updated COVID Guidance

As workplaces resume in-person operations, or at least consider doing so, there are many questions about the rules and requirements. However, the Equal Employment Opportunity Commission has published a lengthy Q&A to help make sure everyone knows how to proceed. Managers and employees may want to review the entire document,

Financial Statements Can Help Evaluate Capital Budgeting Decisions

Strategic investments — such as expanding a plant, purchasing a major piece of equipment or introducing a new product line — can add long-term value. But management shouldn’t base these decisions on gut instinct. A comprehensive, formal analysis can help minimize the guesswork and maximize your return on investment. Forecasting

Generate Cash Flow with These Tax Accounting Method Changes

Cash flow preservation remains an important focus for many companies as the COVID-19 pandemic continues to create uncertainty for businesses. Accounting method changes provide a valuable opportunity for taxpayers to reduce their current tax expense and increase cash flow by accelerating deductions and/or deferring income. Changing to an optimal method

2021 Advance Child Tax Credit Payments Coming Soon

Eligible parents will soon begin receiving payments from the federal government. The IRS announced that the 2021 advance child tax credit (CTC) payments, which were created in the American Rescue Plan Act (ARPA), will begin being made on July 15, 2021. How have child tax credits changed? The ARPA temporarily

Spendthrift Trusts Provide Extra Protection

Now that the federal gift and estate tax exemption has reached an inflation-adjusted $11.7 million for 2021, fewer estates are subject to the federal tax. And even though President Biden has proposed reducing the exemption to $3.5 million, it’s uncertain whether that proposal will pass Congress. If nothing happens, the

Restaurant Revitalization Fund Program Opens May 3rd

The SBA announced they will start accepting applications for the Restaurant Revitalization Fund (RRF) program on Monday, May 3rd. Applicants must register for the SBA application portal and can do so starting on Friday, April 30th at 9:00 am (EST). The applications will open on Monday, May 3rd at noon

IRS Provides Safe Harbor for PPP Loan Deductions

The IRS and the Treasury Department on April 22 released guidance that provides a safe harbor for businesses that received Paycheck Protection Program (PPP) loans in the first round of relief but did not deduct otherwise eligible business expenses because they relied on now-superseded guidance. Under prior guidance, businesses that