Blog

PPP Loans of $2 Million or More Will be Audited

Earlier in the year, the Small Business Administration (SBA) announced in an updated FAQ on the program that it will be auditing all Paycheck Protection Program (PPP) loans of $2 million or more. Borrowers whose loans meet this threshold amount might receive a Loan Necessity Questionnaire from their lender soon after they apply for

DWC Makes Top 200 Private Colorado Companies List

Dalby, Wendland & Co., P.C. (DWC) was recently named a Top 200 Private Company in Colorado by ColoradoBiz. DWC moved up in rank to 54 this year (from 80 in 2019). In serving Colorado for 72 years, it is the sixth oldest business featured on the list. Companies must be

2020 Year-End Tax Strategies for Businesses

As the world continues to contend with the COVID-19 pandemic and its economic fallout, businesses are doing all they can to mitigate risks and plan for a recovery that’s anything but certain. The path forward will likely not be linear. Different regions, industries and business segments may be in different stages

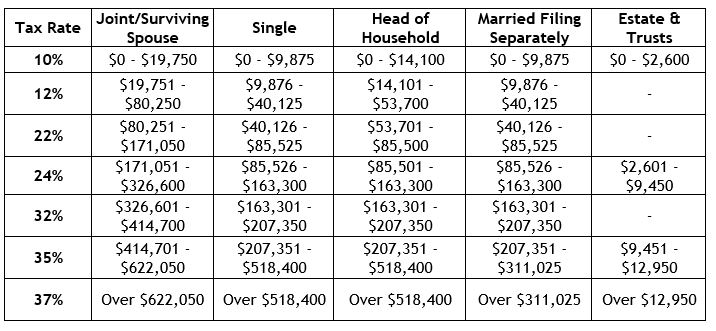

2020 Year-End Tax Planning Highlights for Individuals

As the year-end approaches, individuals, business owners and family offices should be reviewing their situations to identify any opportunities for reducing, deferring or accelerating tax obligations. Areas that should be looked at in particular include tax reform provisions that remain in play, as well as new opportunities and relief

4 Best Practices for Cash Flow Forecasting

Cash flow is a top concern for most businesses today. Cash flow forecasts can help you predict potential shortfalls and proactively address working capital gaps. They can also help avoid late payments, identify late-paying customers and find alternative sources of funding when cash is tight. To keep your company’s cash

Qualified Improvement Property Depreciation

Earlier this year, Congress finally passed legislation that corrects a drafting error related to real estate qualified improvement property (QIP). The correction is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The correction retroactively allows real property owners to depreciate QIP faster than before, either 100% the

Benefits of Being a Small Business

Small businesses enjoy several tax advantages that may allow them to reduce their tax bills, defer taxes and simplify the reporting process. Until recently, federal tax rules generally defined “small business” as one with average annual gross receipts of $5 million or less ($1 million or $10 million in some

Out-of-State Workers and/or Sales May Trigger State Nexus Laws

Does your company conduct sales in states in which you are not registered or in which you have not filed sales and use tax returns? Does your company ship goods or provide services to customers located in states where you have little or no in-state physical presence? Do you have

2021 Social Security Wage Base is Increasing

If your small business is planning for payroll next year, be aware that the “Social Security wage base” is increasing. The Social Security Administration recently announced that the maximum earnings subject to Social Security tax will increase from $137,700 in 2020 to $142,800 in 2021. For 2021, the FICA tax

How long should you keep tax records?

You likely have multiple years of tax-related documents piled up. Which tax records can you toss once you’ve filed each year? Now is a good time to go through old tax records and see what you can discard. The General Rules At minimum, you should keep tax records for as