Blog

DWC Continues Colorado Safer at Home Through June 1st

Dear Clients, We continue to monitor COVID-19 issues and as more businesses reopen and people head back to work, DWC will maintain a more conservative approach for the safety of our employees, families, clients, and community. Therefore, our physical offices will remain closed to visitors and we continue to discourage

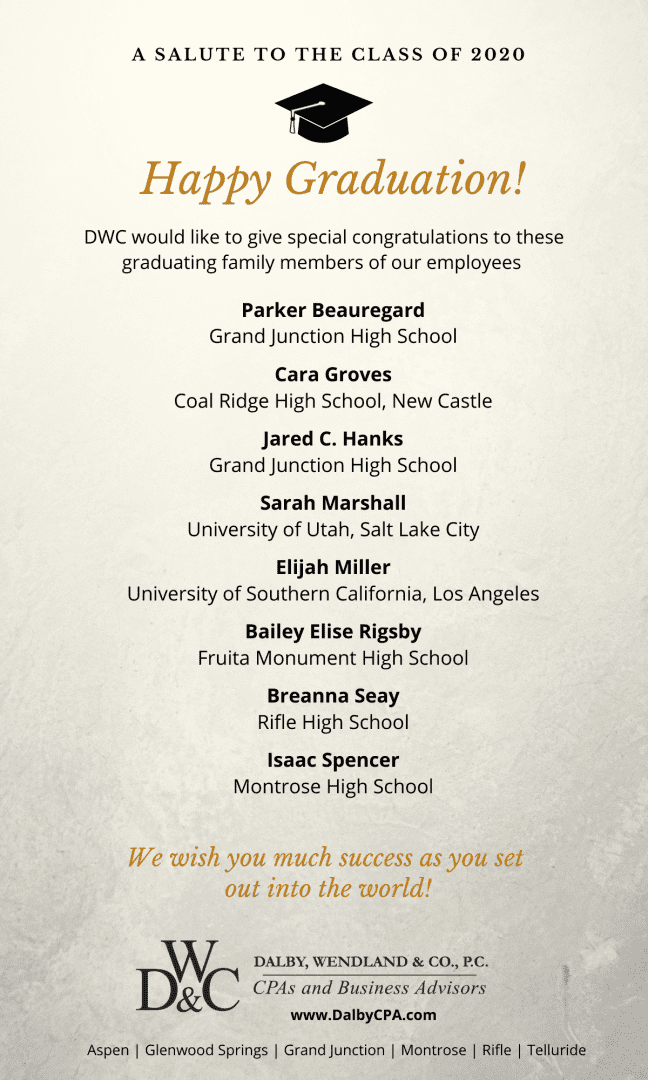

Happy Graduation to the Class of 2020!

COVID-19 disrupted the many traditions high school and college seniors typically get to participate in. We understand these are life-long memories with friends and family that cannot be replaced. DWC wishes to celebrate all 2020 graduates and give a special shout-out to these graduating seniors and family members of our

Safe Harbor Guidance for Necessity of PPP Loan Request

Borrowers who receive a PPP loan must certify in good faith that current economic uncertainty makes the loan request necessary to support ongoing operations of the applicant. However, borrowers and others expressed concern as to what measures define “necessity” and what documentation is required to prove it. On May 13th,

Rule Changes Regarding Your IRAs, RMDs, and Estate Plan

Many people’s estates typically include IRAs. Be aware that two major laws passed into law recently, the Setting Every Community Up for Retirement Enhancement (SECURE) Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act, have had a direct effect on IRAs. In a nutshell, the CARES Act waives

CARES Act NOL Deduction Changes

The Coronavirus Aid, Relief, and Economic Security (CARES) Act eliminates some of the tax-revenue-generating provisions included in a previous tax law. Here’s a look at how the rules for claiming certain tax losses have been modified to provide businesses with relief from the novel coronavirus (COVID-19) crisis. NOL Deductions Basically,

Should you convert your traditional IRA to a Roth IRA?

The coronavirus (COVID-19) pandemic has caused the value of some retirement accounts to decrease because of the stock market downturn. But if you have a traditional IRA, this downturn may provide a valuable opportunity: It may allow you to convert your traditional IRA to a Roth IRA at a lower

Business Interruption Insurance Expectations

A natural place to turn when disaster strikes is insurance. The very reason you pay premiums and deal with the paperwork is to have these risk management policies in place when necessary. But, when it comes to business interruption coverage, you may have to adjust your expectations if you intend

Why Normalizing Adjustments are Essential to Benchmarking

Financial statements aren’t particularly meaningful without a relevant basis of comparison. There are two types of “benchmarks” that a company’s financials can be compared to — its own historical performance and the performance of other comparable businesses. Before you conduct a benchmarking study, however, it’s important to make normalizing adjustments

Expenses Paid with Forgiven PPP Loan Proceeds are NOT Tax Deductible

In Notice 2020-32, IRS recently provided guidance on the deductibility of expenses paid with proceeds from the Paycheck Protection Program loan for federal income tax purposes. The notice states that no deduction is allowed under the federal code for an expense that is otherwise deductible if the payment of the

Properly Classify Independent Contractors

As a result of the coronavirus (COVID-19) crisis, your business may be using independent contractors to keep costs low. But you should be careful that these workers are properly classified for federal tax purposes. If the IRS reclassifies them as employees, it can be an expensive mistake. The question of