Blog

DWC’s Montrose Office is Moving to New Building

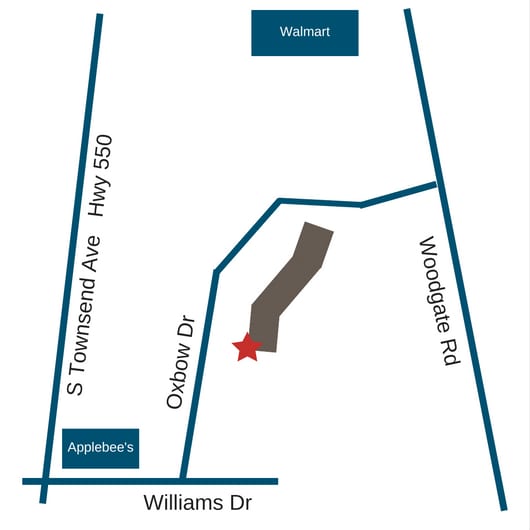

Dalby, Wendland & Co., P.C., in Montrose will be relocating to new offices at the Tower Building (1544 Oxbow Drive, Suite 101) the week of July 30th. The office will be closed Thursday, July 26th through Tuesday, July 31st and will reopen for regular business on Wednesday, August 1st. Our

Choosing the Best Business Entity Structure Post-TCJA

For tax years beginning in 2018 and beyond, the Tax Cuts and Jobs Act (TCJA) created a flat 21% federal income tax rate for C corporations. Under prior law, C corporations were taxed at rates as high as 35%. The TCJA also reduced individual income tax rates, which apply to

Consider Long-Term Deal for Succession Planning

Some business owners — particularly those who founded their companies — may find it hard to give up control to a successor. Maybe you just can’t identify the right person internally to fill your shoes. While retirement isn’t in your immediate future, you know you must eventually step down. One

Businesses and the Tax Consequences of Accepting Bitcoin

Over the last several years, virtual currency has become increasingly popular. Bitcoin is the most widely recognized form of virtual currency, also commonly referred to as digital, electronic or crypto currency. While most smaller businesses aren’t yet accepting bitcoin or other virtual currency payments from their customers, more and more

Dalby Wendland in Rifle Relocates to New Office Space

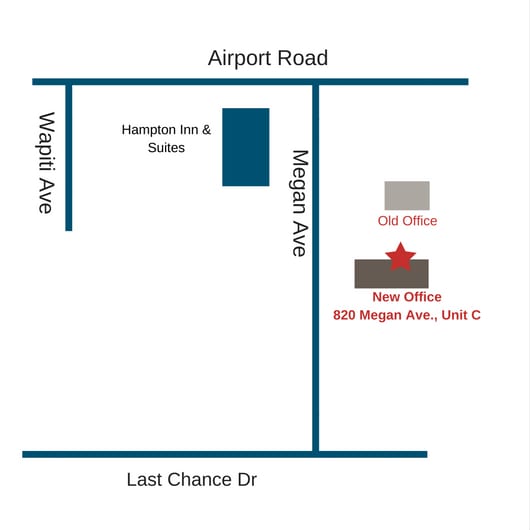

Dalby, Wendland & CO., P.C.’s Rifle office has relocated to new space at 820 Megan Ave., Unit C. The new office is just up the street from the prior space. Firm Principal Duane Antes, CPA, will continue to oversee the office. Antes notes, “The Firm opened the Rifle office in

Consider a Spousal Lifetime Access Trust for Estate Planning

The most effective estate planning strategies often involve the use of irrevocable trusts. But what if you’re uncomfortable placing your assets beyond your control? What happens if your financial fortunes take a turn for the worse after you’ve irrevocably transferred a sizable portion of your wealth? If your marriage is

Protect Your Estate Plan from Undue Influence Claims

Of course, you expect the declarations in your will to be carried out, as required by law. Usually, that’s exactly what happens with wills. However, it’s possible your will could be contested and your true intentions defeated if someone is found to have exerted “undue influence” over your decisions. Undue

Tax Law Changes for Business Sponsored 401(k) Plans

When you think about recent tax law changes and your business, you’re probably thinking about the new 20% pass-through deduction for qualified business income or the enhancements to depreciation-related breaks. Or you may be contemplating the reduction or elimination of certain business expense deductions. But there are also a couple

Collecting Sales Tax on all Out-of-State Online Sales

You’ve probably heard about the recent U.S. Supreme Court decision allowing state and local governments to impose sales taxes on more out-of-state online sales. The ruling in South Dakota v. Wayfair, Inc. is welcome news for brick-and-mortar retailers, who felt previous rulings gave an unfair advantage to their online competitors.

Businesses: Time for a MidYear Review

Every year is a journey for a business. You begin with a set of objectives for the months ahead, probably encounter a few bumps along the way and, hopefully, reach your destination with some success and a few lessons learned. The middle of the year is the perfect time to