Divorce brings personal challenges, but addressing tax concerns is crucial to minimize taxes and make informed decisions. Here are six key tax issues to consider.

Divorce brings personal challenges, but addressing tax concerns is crucial to minimize taxes and make informed decisions. Here are six key tax issues to consider.

Personal Residence Sale

In a divorce, couples can avoid tax on up to $500,000 of gain from selling their home if it was their principal residence for two of the past five years. If one spouse moves out but remains an owner, they can each exclude up to $250,000 of gain on a future sale, with special language in the divorce decree. If the two-year tests aren’t met, a reduced exclusion may apply.

Filing Status

If you’re still married at year’s end, you’re treated as married for taxes. A tax professional can help determine your filing status, including potential “head of household” eligibility.

Alimony or Support Payments

For divorce agreements executed after 2018, alimony payments are not tax-deductible for the payer and are not included in the recipient’s gross income. This change, made by the Tax Cuts and Jobs Act, is permanent and does not apply to agreements made before 2019.

Child Support & Child-Related Tax Return Filing

No matter when the divorce or separation instrument is executed, child support payments aren’t deductible by the paying former spouse (or taxable to the recipient). You and your ex-spouse will also need to determine who will claim your child or children on your tax returns in order to claim related tax breaks.

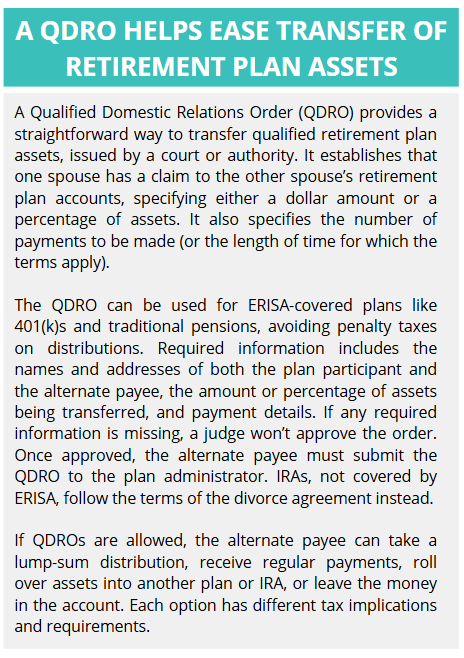

Pension Benefits

In a divorce, pension benefits are often divided through a “qualified domestic relations order” (QDRO), allowing one spouse to share the other’s benefits and be taxed on them. Without a QDRO, the spouse who earned the benefits is still taxed on payments made to the other spouse. See sidebar for more on QDROs.

Business Interests

When business interests are transferred in a divorce, it’s important to avoid losing tax attributes. For example, transferring S corporation interests can lead to forfeiture of “suspended” losses. If a partnership interest is transferred, more complex issues may arise, including partners’ shares of debt, capital accounts, and built-in gains on contributed property. Careful planning is essential to preserve these tax benefits during the transfer.

Business owners and high net-worth individuals may need special planning and guidance regarding divorce, taxes, and retirement and wealth planning. You should always engage legal and financial advisors to ensure all formalities are met to avoid issues.

DWC tax professionals and DWC Wealth Advisors collaborate to help ensure your financial planning and strategy are integrated with a goal of building and preserving your wealth.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. Investment advisory services offered through Global Retirement Partners, LLC (GRP) dba DWC Wealth Advisors, an SEC registered investment advisor. GRP and DWC CPAs and Advisors are separate and unaffiliated entities.