Blog

Tax & Legislative Update “One Big Beautiful Bill Act”

Congress is currently debating a sweeping piece of legislation titled the One Big Beautiful Bill Act (H.R. 1), which carries major implications for both individuals and businesses. While the bill has already passed in the House, the Senate is actively reviewing it and just passed its tax plan version with a

What to Know About Harvesting Capital Losses as a Tax-Saving Strategy

Stock, mutual fund and ETF prices have bounced around lately. If you make what turns out to be an ill-fated investment in a taxable brokerage firm account, the good news is that you may be able to harvest a tax-saving capital loss by selling the loser security. However, for federal

Estimating Fair Value

Many balance sheet items are reported at historical cost. However, current accounting standards require organizations that follow U.S. Generally Accepted Accounting Principles (GAAP) to report certain assets and liabilities at “fair value.” This shift aims to enhance transparency and reflect an entity’s current financial position more accurately. However, estimating fair

Beware of the 100% Penalty

Some tax sins are much worse than others. An example is failing to pay over federal income and employment taxes that have been withheld from employees’ paychecks. In this situation, the IRS can assess the trust fund recovery penalty, also called the 100% penalty, against any responsible person. It’s called the

Hiring Your Child Can Provide Your Business Tax Savings

With summer fast approaching, you might be considering hiring young people at your small business. Did you know that hiring your children can help you save on family income and payroll taxes? It's a win-win situation for everyone! Here are three tax benefits. 1. You can transfer business earnings Turn

Minimizing Taxes on Inherited Assets: How the Step-Up in Basis Works

When someone passes away and leaves assets to heirs, the recipients often receive a valuable but sometimes misunderstood tax benefit known as the step-up in basis. This rule can significantly reduce capital gains taxes for the beneficiary and is also an important consideration in estate planning. What Is Basis? Basis

“Reasonable Compensation” Rules for C Corps and S Corps: What Business Owners Need to Know

Setting reasonable compensation is one of the most important — and often overlooked — compliance issues for C corporation and S corporation owners. Getting it wrong can lead to IRS audits, reclassified income, back taxes, penalties, and a major headache. Whether you’re paying yourself too much or too little, the

Why do Businesses Use QuickBooks for Bookkeeping?

Accurate financial records are essential for managing cash flow, meeting tax obligations, and supporting strategic planning. A solid bookkeeping software provides the foundation for sound business decisions and long-term growth. There is a large number of bookkeeping software for businesses on the market today but QuickBooks® still remains the one

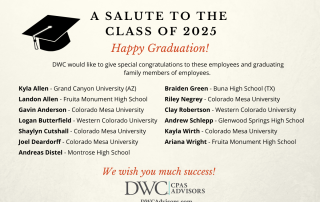

Congrats 2025 Graduates!

Congratulations 2025 graduates and a special shoutout to those close to our people and teams! Your hard work, dedication, and resilience have paid off. Cheers to chasing dreams, embracing challenges, and building a bright future!

Six Tax Issues to Consider if You’re Getting a Divorce

Divorce brings personal challenges, but addressing tax concerns is crucial to minimize taxes and make informed decisions. Here are six key tax issues to consider. Personal Residence Sale In a divorce, couples can avoid tax on up to $500,000 of gain from selling their home if it was their principal