Blog

The Financial and Nonfinancial Skills CFOs Should Have

Is your company planning to hire a new CFO? A recent survey found that hiring managers look for more than financial acumen when vetting CFO candidates. In fact, only 38.5% of CFOs at Fortune 500 and S&P 500 companies were licensed CPAs in 2023, according to executive recruiting firm Crist

New Final IRS Regulations for Inherited IRAs

A tax law change in 2019 essentially ended “stretch IRAs” by requiring most beneficiaries of inherited IRAs (other than a spouse) to withdraw all of the funds within 10 years. Since then, there’s been confusion surrounding inherited IRAs and the so called “10-year rule” for required minimum distributions (RMDs). That

Remember Foreign Assets in Your Estate Plan

Failing to address any foreign assets you possess in your estate plan can cause unexpected outcomes. The good news is that with the help of an experienced estate planning advisor, you can structure the ownership of your foreign assets according to the laws of the U.S. and the country where

Bookkeeping 101 – Understanding Debits and Credits

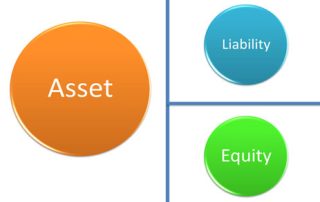

Bookkeeping fundamentals are essential to accurate financial reporting. Using software solutions — such as QuickBooks® — can simplify double-entry accounting. However, knowing how the process works can provide reassurance that your business is properly tracking its financial transactions. Explanation of Debit and Credits Assets are items of value that your

Should you change from a C corp to an S corp?

Choosing the right business entity has many implications, including the amount of your tax bill. The most common business structures are sole proprietorships, partnerships, limited liability companies, C corporations and S corporations. In some cases, a business may decide to switch from one entity type to another. Although S corporations can provide substantial

The Satisfaction Equation

Chris West, CPA, PFS Grandma would always tell us kids to “save some money for a rainy day.” Grandma was always very wise in many matters, and being wise with money was no exception. Essentially, Grandma was referring to the three foundational behaviors of building wealth, which are:

What is protected from creditors?

The executors are settling an estate — but the decedent owes money. What can the creditors take and what is reserved for the inheritors? There is no easy answer, and a variety of federal and state laws apply. To start with, retirement accounts that qualify under the Employee Retirement Income

Climb the Fixed Income Staircase

The bond ladder concept can be simple at the outset: You just need some basic arithmetic to divide up your fixed income allocation into a staggered schedule designed to mature at predictable intervals. Dependable cash flow can provide peace of mind, and spreading maturities can spare you from making big

Can a Business Partner Deduct Incurred Expenses Related to the Partnership’s Business?

It’s not unusual for a partner to incur expenses related to the partnership’s business. This is especially likely to occur in service partnerships such as an architecture or law firm. For example, partners in service partnerships may incur entertainment expenses in developing new client relationships. They may also incur expenses

A Strategy to Help Save Tax When Selling Appreciated Vacant Land

Let’s say you own one or more vacant lots. The property has appreciated greatly and you’re ready to sell. Or maybe you have a parcel of appreciated land that you want to subdivide into lots, develop them and sell them off for a big profit. Either way, you’ll incur a